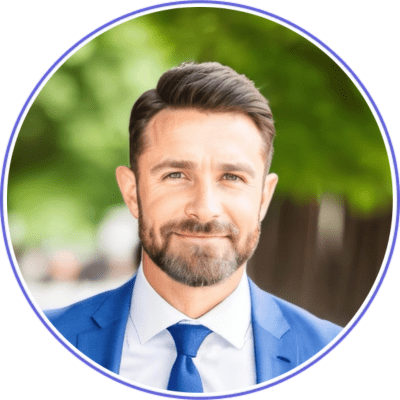

Scott Tenenbaum

Head of Claims, North America, Resilience

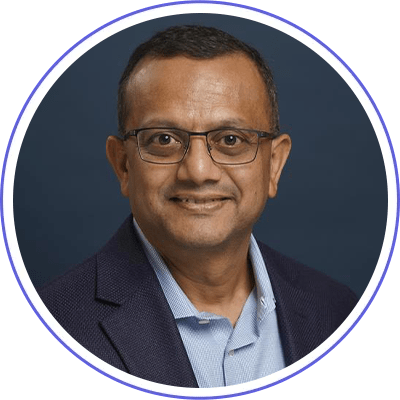

Imran Khan

VP Cyber Security Transformation Lead, BNP Paribas

Hiral Mehta

Partner,

Mayer Brown LLP

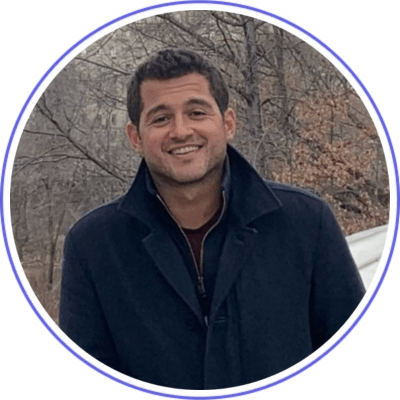

David Anderson

Vice President, Cyber, Woodruff Sawyer

Vlad Brodsky

Senior Vice President, Chief Information Officer, OTC Markets Group and CyberEdBoard Member.

Kimberly Pack

Counsel, Thompson Hine

Speakers

Thought Leaders on Stage Leading Deep-Dive Discussions

ISMG Summits bring the foremost thought leaders and educators in the security space to the stage, interactive workshops and networking events. Learn from the “who’s who” in Cybersecurity passionate about the latest tools and technology to defend against threats